You think you’re doing payroll right. You’ve got your techs out in the field, they’re hitting 50 hours a week, and you’re paying them time and a half for those extra 10 hours. Simple, right?

In some states, that simple math could cost you millions in penalties.

Between daily overtime rules, seventh-consecutive-day requirements, and calculating adjusted rates that include bonuses, payroll compliance in the trades has become a minefield.

That’s why we built OvertimeIQ. It’s a state-compliant rules engine designed to automate the complex math of overtime — and it works across all 50 states.

Why Federal Rules Aren't Enough

Most business owners follow federal guidelines: time and a half for anything over 40 hours in a workweek. But state laws often supersede federal ones, and they can be significantly more aggressive.

Take California, for example. They have a daily overtime rule. If a tech works nine hours on Monday, that ninth hour is overtime, even if they don't hit 40 hours for the week. If they work seven days in a row, that seventh day can trigger double-time rates.

When I was talking to a customer in Louisiana recently, they were relieved because their state follows basic federal rules. But if you operate across state lines or in high-regulation areas, manual spreadsheets aren't just slow, they could put you at risk of penalties.

The biggest mistake I see service business owners make is calculating overtime based solely on a technician’s base hourly pay.

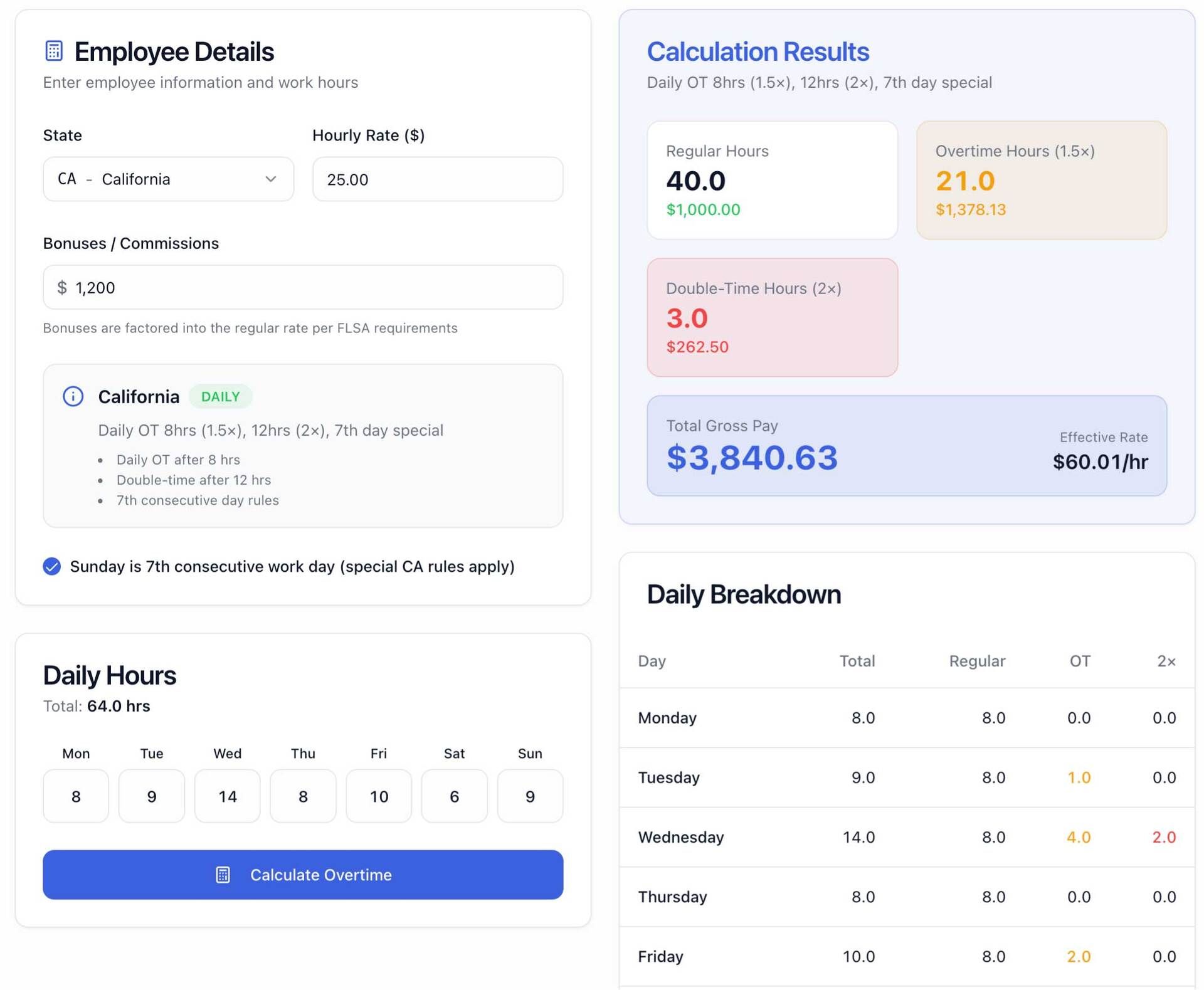

What is an adjusted rate? The adjusted rate (or regular rate of pay) is a weighted average that includes a technician's base hourly pay plus all non-discretionary bonuses, commissions, and performance-based pay.

In states like California, you can’t exclude bonuses from your overtime calculation. If Alex Smith makes $26.82 an hour but also earns a $500 bonus for hitting an efficiency target, his overtime rate must be 1.5x of his adjusted rate, not his base $26.

Tip: You don't have to do this math on a napkin. By using OvertimeIQ, you can automatically factor in every bonus and commission into your adjusted rates in seconds.

How OvertimeIQ Works

Here is how OvertimeIQ helps to automate your compliance:

Upload Your Data: You can drag and drop your "Master Pay File" directly from tools like ServiceTitan or HouseCall Pro.

Map Your Columns: Tell the tool which column is "Paid Duration" and which is "Hourly Rate."

Factor in Bonuses: Upload your non-discretionary bonuses. OvertimeIQ automatically crunches these into the adjusted rate for each employee.

Run the Rules Engine: Choose your state (e.g., Florida vs. California). The tool instantly shifts the math based on that specific state's rules—applying daily OT or weekly OT as required.

The result? A clean export of compliant overtime pay, ready for your payroll processor.

Is Your Payroll State-Compliant?

Don't wait for penalties to land, use OvertimeIQ to find out. We’ve built OvertimeIQ to give you total peace of mind. We’ll be integrating with ShareWillow soon, but you can get started now at OvertimeIQ.com.

P.S. Any questions or want more information? Hit reply - all responses land directly in my inbox.